for a long time, the main problem facing the car finance profession is risk control, material fraud, fraud and loan evasion, vehicle secondary pawn, removal of tracking devices for cars that can be hidden and other bad behaviors emerge in endless. That's a lot of effort on both sides for a car. Take the car loan as an example, from the borrower's vehicle evaluation, review, registration, loan, including post-loan, telephone verification, collection and so on, in such a process, risk control is still facing great challenges. Repeatedly presented news reports that after the vehicle was pawned twice, both sides fought for a car. The mutual game between the two sides makes car financial risk control have to be mentioned repeatedly in the profession.

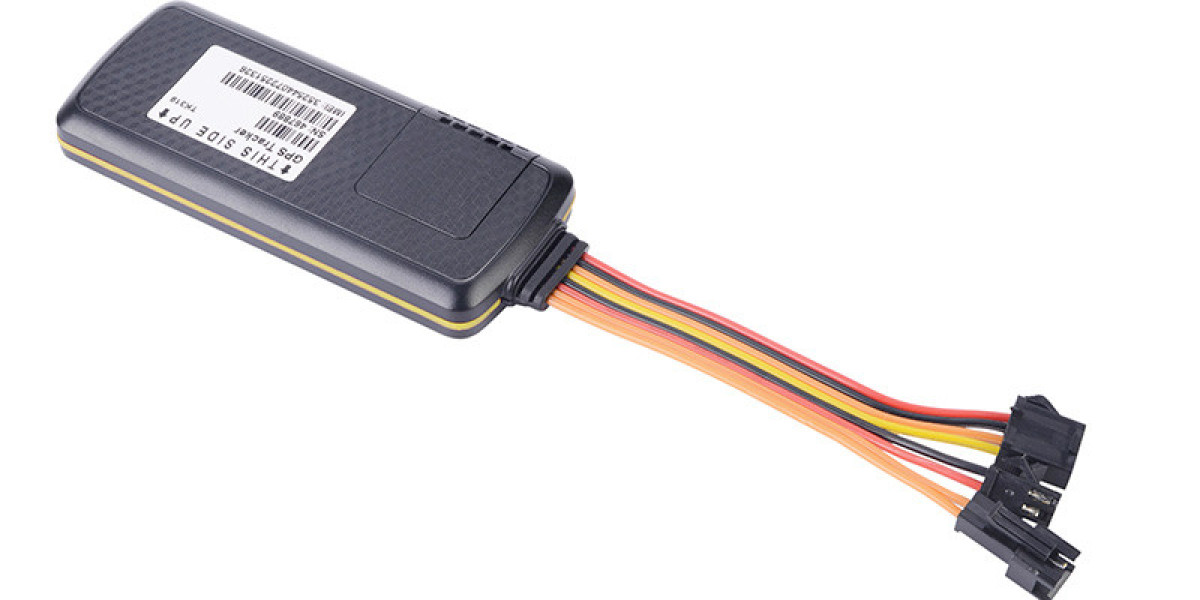

Nowadays, car finance is more and more difficult to do, and many car finance loan enterprises reduce the borrowing threshold to a low level in order to snatch customers. With it comes the danger that the enterprise itself is difficult to control, and it is very possible to work hard for a whole year, lose a car, and change the day back to before liberation. So now the vast majority of enterprises on the market choose to loan vehicles to track devices for cars that can be hidden to control the risk. When the customer defaults, the enterprise can find the borrowing vehicle in time through the positioning system.

At present, the risk control of car finance is divided into pre-loan vehicle evaluation and post-loan vehicle monitoring. The pre-loan evaluation of the vehicle is primarily to conduct a comprehensive inspection of the vehicle and estimate its value. Post-loan monitoring is mainly through the GPS hardware device, as well as the software system for real-time tracking and positioning of the vehicle.

But sometimes there will be professional loan fraud personnel in the enterprise to cheat loans. After the fraudsters borrowed money to buy vehicles, they hid their names in order to get more money in pawn. Even if the vehicle is tracked, the fight for this one car, the loss is huge. Even some vehicles are sold, people and cars are empty. Sometimes when the customer is overdue, the car chase personnel arrive at the scene according to GPS positioning, and have already missed the opportunity to chase the car. Therefore, a simple GPS positioning system can not avoid many dangers. What we need more is to go through the defense detection, to reduce the risk and loss.

When the vehicle presents some abnormal behavior, the monitoring platform will make some reactions and prompts, so that the administrator can verify the vehicle information and use status in a timely manner, especially when the vehicle travels to the unmonitored local area, resulting in the failure of signal transmission. It may produce tracking devices for cars that can be hidden by the removal of the secondary pawn situation, so the GPS monitoring of vehicles is primarily to avoid the danger of losing and secondary borrowing.

Facing these inevitable dangerous problems in the car finance profession, tracking devices for cars that can be hidden to control the vehicle and monitor the intention of the vehicle in real time; It has been proved that with the more and more perfect GPS technology, the role of GPS will be played, and the danger of car credit occupation will be reduced.

tracking devices for cars that can be hidden https://www.eelinktracker.com/Magnetic-GPS-Tracker/