Why Businesses Are Moving Away from Manual Accounts Payable

- мега сайтмега сайтTime-consuming invoice entry

Frequent errors and duplications

Lost or misplaced invoices

Missed payment deadlinesPoor vendor communication

Lack of visibility into cash flow

These challenges not only eat into productivity but also put your business at risk of late fees, strained vendor relationships, and missed financial opportunities

That’s where outsourced accounts payable services come in — offering an end-to-end solution that replaces chaos with clarity.

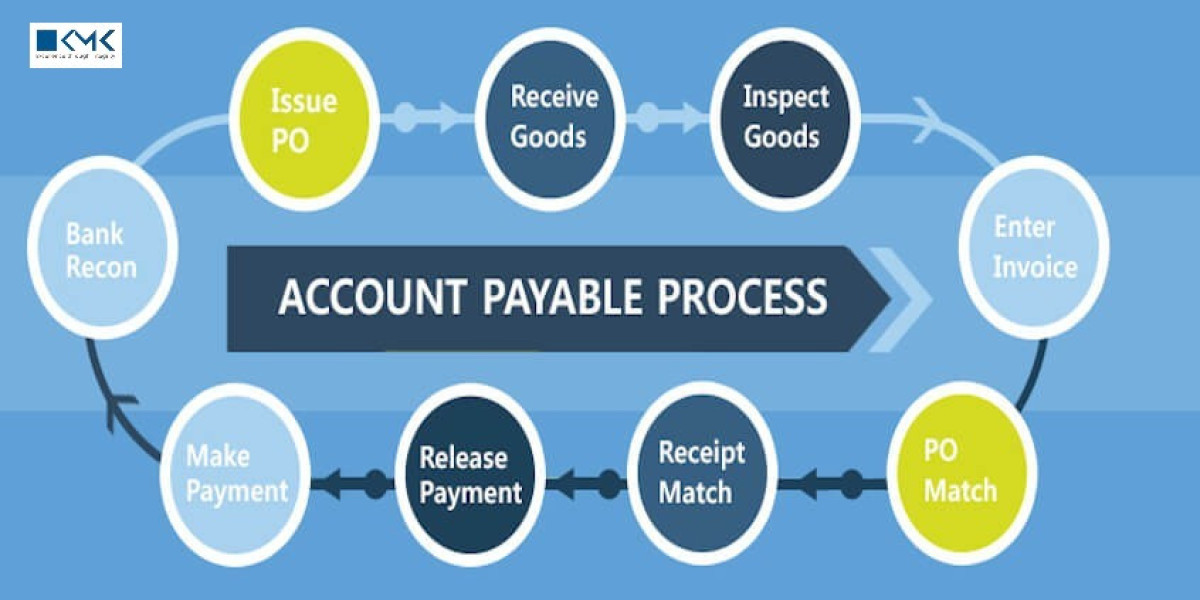

What Are Accounts Payable Outsourcing Services?

Invoice capture and validation

PO matching and approval routing

Payment processing and reconciliation

Vendor communication

Compliance and reporting

The goal? To streamline and optimize your entire AP workflow, reduce costs, and free up your team to focus on high-value tasks.

Benefits of Outsourcing Accounts Payable Services

Before we discuss the transition, let’s quickly highlight why businesses choose to outsource accounts payable services in the first place:

Reduced operational costs

Faster invoice processing

Improved accuracy and compliance

Real-time visibility through dashboards

Better vendor relationships

Scalability without hiring additional staff

Whether you’re a growing startup or an established enterprise, the benefits of outsourced accounts payable services are clear — but transitioning properly is the key to unlocking them.

Step-by-Step Guide to a Smooth Transition

Moving from manual processes to outsourcing accounts payable services doesn’t have to be disruptive. With the right strategy, it can be smooth and even empowering for your finance team.

Here’s how to do it with minimal stress:

Step 1: Evaluate Your Current AP Process

Start with a full audit of your existing AP workflow. Identify:

Invoice volumes and types

Average processing time

Number of full-time staff managing AP

Frequency of errors or delays

Current systems used (if any)

This helps you understand what’s working — and what needs to improve — so your outsourcing partner can build a tailored solution.

Step 2: Choose the Right AP Outsourcing Partner

Not all providers are the same. Look for a company with proven experience in accounts payable services, strong tech integration capabilities, and a track record of helping clients scale.

Key things to consider:

Cloud-based and automation-driven processes

Real-time reporting and dashboards

ERP compatibility

Data security and compliance certifications

Vendor support and communication protocols

A good accounts payable service provider will act like an extension of your finance team.

Step 3: Plan the Transition in Phases

Avoid switching everything overnight. A phased approach reduces risk and stress:

Pilot Phase – Start with a small batch of vendors or invoices

Training & Support – Ensure internal teams understand the new workflows

Full Rollout – Expand to handle all AP activities once the system is tested

Feedback Loop – Continuously improve with regular check-ins and updates

Step 4: Integrate With Your Existing Systems

Smooth integration is critical to success. Make sure your outsourced accounts payable services can connect with your current ERP or accounting software. This allows for:

Real-time syncing

Automatic data imports

Simplified reporting

Reduced manual effort

Popular integrations include QuickBooks, SAP, NetSuite, and Oracle.

Step 5: Communicate With Vendors Early

Inform your vendors about the transition and provide updated instructions for invoice submission. A clear line of communication helps avoid delays and confusion.

Tips:

Send email notifications with new invoice procedures

Share contact information of your AP partner

Set expectations on payment timelines and dispute handling

Step 6: Train Internal Teams

While your AP tasks are being outsourced, your team still plays a role in oversight and exception handling. Conduct short training sessions to help staff:

Understand the new process

Use AP dashboards and reporting tools

Escalate issues when needed

This ensures a collaborative approach between your in-house and outsourced teams.

What to Expect After the Transition

Once you outsource accounts payable services, you’ll start to notice several improvements:

Faster invoice approvals and payments

Lower error rates and fewer disputes

Improved vendor satisfaction

Real-time visibility into liabilities

Stronger internal controls and compliance

Within a few months, most companies see a positive return on investment — and significant time savings.

Final Thoughts

Transitioning from manual AP to outsourced accounts payable services doesn’t have to be stressful. With the right strategy, tools, and partner, you can modernize your financial operations while maintaining control, accuracy, and peace of mind. Whether you’re looking to reduce costs, speed up processing, or scale effortlessly, outsourcing accounts payable services is a smart move that pays off quickly and sustainably.

Ready to make the switch?

At KMK Ventures, we specialize in helping businesses transition from manual chaos to seamless accounts payable outsourcing services. Let our team guide you every step of the way — with zero stress and maximum efficiency.