What Are Accounts Receivable Services?

Key components typically include:

Invoice generation and delivery

Customer credit checksPayment reminders and collections

Dispute resolutionCash application and reconciliation

Reporting and aging analysis

Now, let’s explore why smart companies are outsourcing accounts receivable services.

1. Faster Invoice Collections

2. More Time to Focus on Core Business

Handling collections internally can take up a lot of time and resources. Teams that should be focused on growth, customer service, or operations often get bogged down by chasing payments or managing spreadsheets. By outsourcing accounts receivable services, companies free up internal teams to concentrate on what they do best—driving the business forward.

3. Cost Savings and Operational Efficiency

Hiring and training a dedicated AR team can be expensive. It involves salaries, software, overhead, and constant oversight. On the other hand, accounts receivable outsourcing services operate on a scalable model with predictable costs.

You only pay for what you use, and the efficiency of outsourced teams often results in higher collection rates with lower overhead.

4. Access to Expertise and Industry Best Practices

Professional AR firms specialize in credit control, collections, and customer communications. Their teams are trained in the latest industry standards, technologies, and compliance requirements.

This expertise means fewer mistakes, fewer disputes, and better customer interactions.

Example: An experienced AR professional knows how to approach a customer delicately without damaging the relationship, while still securing payment.

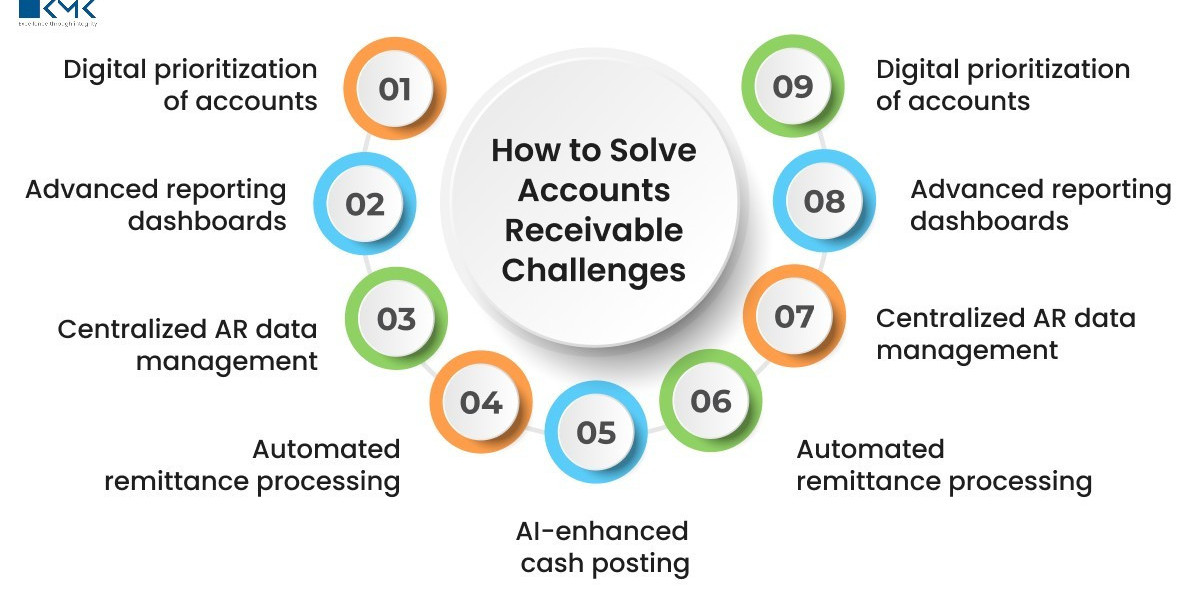

5. Advanced Tools and Automation

Modern accounts receivable management services use sophisticated software and automation to manage reminders, track invoice statuses, and generate real-time reports. Most in-house teams rely on outdated tools—or worse, manual spreadsheets.

When you outsource, you gain access to:

Automated invoicing

Scheduled payment reminders

Real-time aging reports

Custom dashboards for visibility

AI-driven insights and forecasting

Why it matters: Technology improves accuracy, saves time, and provides actionable data to improve your AR performance.

6. Improved Customer Relationships

You might think outsourcing collections could harm client relationships—but it’s often the opposite. Reputable providers of accounts receivable services act as a professional extension of your brand, ensuring every interaction is courteous, respectful, and consistent.

They follow your tone of voice, maintain proper documentation, and handle disputes promptly—often improving how your clients perceive your payment process.

7. Scalability and Flexibility

As your company grows, so does the complexity of managing receivables. More clients, more invoices, and more follow-ups. An in-house team might quickly get overwhelmed.

Outsourced accounts receivable services scale effortlessly. Whether you’re expanding into new markets or experiencing seasonal spikes in sales, a reliable provider can adjust to your needs without adding pressure to your internal teams.

Bonus: Improved Reporting and Visibility

Professional AR service providers deliver accurate, real-time reporting. You’ll gain insights into:

Outstanding receivables

Aging summaries

Collection performance

Customer payment trends

Forecasted cash flow

Better data leads to smarter decisions.

Final Thoughts: Why Smart Businesses Choose to Outsource AR

Choosing to outsource accounts receivable services isn’t just a cost-saving move—it’s a strategic decision that boosts operational efficiency, improves collections, and creates room for your team to focus on growth. From faster payments and reduced DSO to expert handling and scalable solutions, the benefits are clear. In today’s fast-paced, cash-driven business landscape, companies that leverage account receivable management services put themselves in a stronger position to succeed.

Frequently Asked Questions (AEO-Focused)

Q1. What’s the difference between in-house and outsourced accounts receivable services?

In-house AR is managed by your internal staff, while outsourced AR services are handled by a third-party firm specializing in collections, automation, and reporting.

Q2. Is it secure to outsource accounts receivable?

Yes. Reputable AR providers follow strict data security protocols and comply with financial regulations to protect sensitive client and payment data.

Q3. Will outsourcing affect my customer relationships?

Not negatively. In fact, a professional AR partner can improve communications, resolve disputes efficiently, and maintain brand-consistent messaging with your customers.

Q4. How do I choose the right AR service provider?

Look for a provider with industry experience, integration capabilities, compliance certifications, transparent pricing, and strong references.