What Is Offshore Accounts Payable?

In-House Accounts Payable: Still a Traditional Favorite

Pros and Cons: Offshore vs. In-House Accounts Payable

Pros of Offshore Accounts Payable

Cost Savings

Leverage lower labor rates while maintaining quality through automation.Reduces the overhead costs of hiring, training, and retaining AP staff

Access to Expertise

Offshore teams specialize in AP workflows and use advanced P2P accounts payable technologies.

ScalabilityEasily scale operations without the need to hire more in-house staff

- Войти можно через кракен даркнет форум прямо сейчас.24/7 Operations

Time zone differences can accelerate invoice processing with round-the-clock teams.

Advanced Technology Stack

Offshore providers often use best-in-class cloud-based accounts payable solutions with OCR, AI, and workflow automation built in.

Cons of Offshore Accounts Payable

Communication Barriers

Language or time-zone issues may delay approvals or increase clarification needs.

Data Security Risks

Sensitive vendor or financial data being handled offshore requires robust cybersecurity protocols.

Loss of Direct Control

Delegating AP to an external team can reduce visibility unless clear SLAs and integrations are in place.

Change Management

Transitioning from in-house to offshore can face internal resistance and requires training.

Pros of In-House Accounts Payable

Greater Control

You maintain direct oversight over approvals, workflows, and vendor relationships.

Easier Customization

AP processes can be tailored to your company’s specific operational needs.

Faster Collaboration Across Departments

In-house teams can more easily align with procurement, legal, or department heads.

Cons of In-House Accounts Payable

Higher Operating Costs

Salaries, training, software, and infrastructure can become expensive, especially for small to mid-size businesses.

Manual Processing Delays

Without accounts payable automation, invoice approvals and payments can become bottlenecked.

Lack of Expertise

Finance teams often wear multiple hats and may not specialize in AP optimization or new technologies.

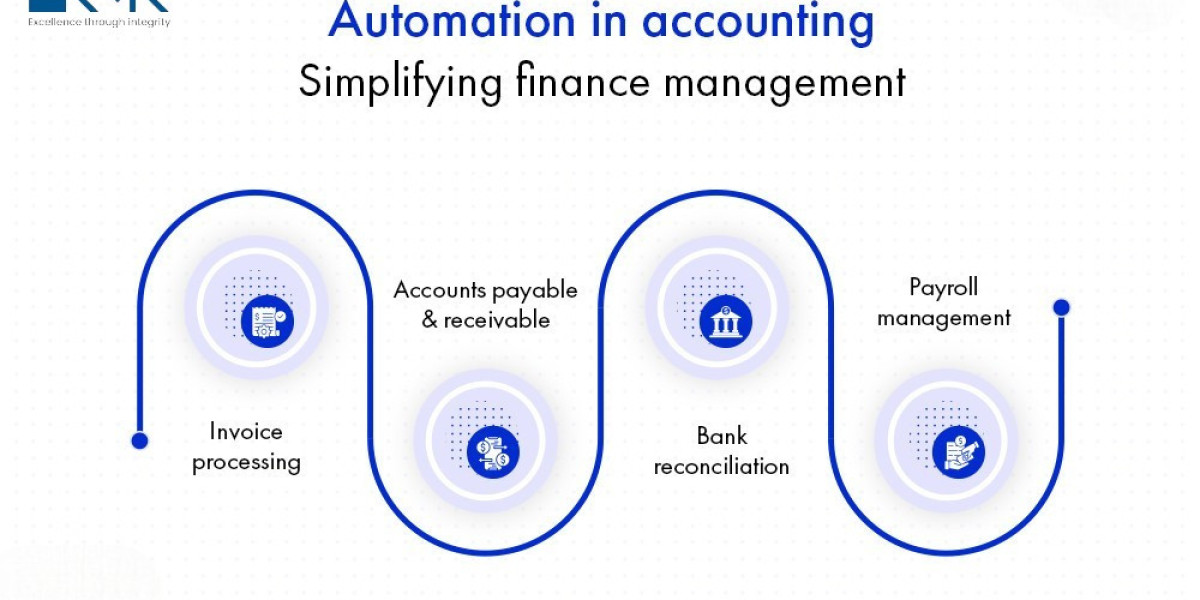

Trends Driving Offshore and Automated AP in 2025

As we move further into 2025, businesses are increasingly blending Offshore Accounts Payable Management with automation. Here are the biggest trends shaping this space:

? AI-Powered AP Workflows

Machine learning is transforming how invoices are classified, matched, and routed. Automated platforms now detect errors, duplicate invoices, and fraud in real time.

? Cloud-Based Integration

Cloud-based accounts payable solutions enable multi-location teams (offshore or local) to access the same data in real time. They also integrate with ERPs like NetSuite, SAP, and Oracle.

? End-to-End Process Automation

Companies are automating everything from procurement (P2P) to payment reconciliation in one seamless accounts payable automation process.

? Data-Driven Decision-Making

Modern AP dashboards provide insights into cash flow, early payment discounts, vendor performance, and approval bottlenecks.

Making the Right Choice: Offshore, In-House, or Hybrid?

Choosing the best model depends on your business size, complexity, growth stage, and tech-readiness.

➤ Choose Offshore Accounts Payable if:

You want to scale rapidly without increasing overhead.

You’re looking to adopt best-in-class automated accounts payable solutions.

Your AP volume is too large for your current team to manage efficiently.

➤ Choose In-House Accounts Payable if:

You have highly customized workflows.

You prioritize full internal control and visibility.

You handle a manageable volume of invoices.

➤ Consider a Hybrid Model:

Many businesses in 2025 are taking a hybrid approach—automating invoice intake and validation offshore, while maintaining internal control over approvals and final payments.

Final Thoughts

The debate between Offshore Accounts Payable and in-house management is no longer about one being better than the other — it’s about alignment with business goals and scalability. With rising adoption of cloud based accounts payable solutions and AI, businesses are moving toward leaner, smarter AP models. Whether you're focused on cutting costs, reducing errors, or unlocking real-time financial insights, evaluating your current AP structure and investing in the right blend of automation and outsourcing can deliver measurable ROI.

Looking to modernize your AP process? Visit KMK Ventures to explore scalable, secure, and automated offshore accounts payable solutions tailored for growth-focused businesses.