For CFOs, the pressure to maintain strong cash flow, reduce Days Sales Outstanding (DSO), and improve financial efficiency has never been greater. Yet, many businesses still struggle with manual processes, slow collections, and outdated systems. That’s where the right accounts receivable services partner can make all the difference. But with countless accounts receivable outsourcing services available ranging from local firms to offshore accounts receivable services—how do you choose the right one for your business? This comprehensive guide is designed specifically for CFOs and finance leaders who want to make a strategic, informed decision that balances cost, compliance, customer experience, and long-term scalability.

Why CFOs Are Rethinking Accounts Receivable Management

Accelerated cash flow

мега сайтмега сайтReduced operational costs

Predictive payment analyticsStreamlined reconciliation and dispute resolution

Access to expert teams and automation tools

The shift toward outsourced accounts receivable services isn’t just a trend—it’s a proactive strategy to future-proof financial operations.

Key Benefits of Outsourcing AR Services

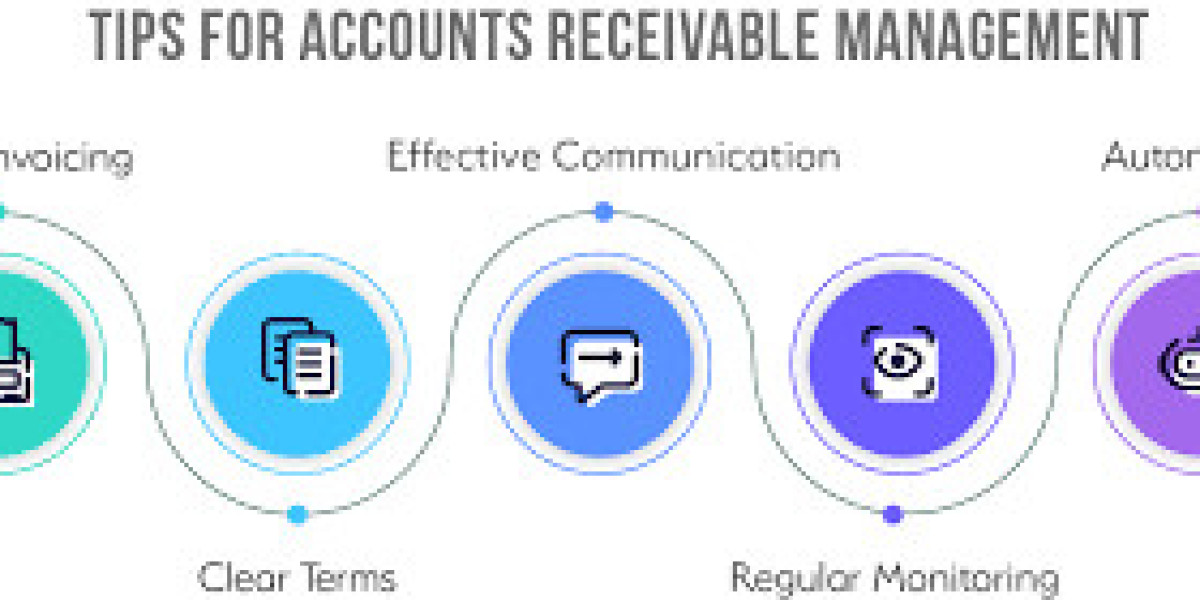

Before diving into selection criteria, here’s a quick recap of what the right accounts receivable outsourcing services can offer:

✅ Reduced DSO (Days Sales Outstanding)

✅ Lower overhead through automation and offshore talent

✅ Scalability during high-growth periods

✅ 24/7 customer and collections support

✅ Improved accuracy and compliance

✅ Stronger visibility into receivables through cloud-based dashboards

What to Look for in the Ideal AR Service Provider

Here’s what CFOs should evaluate when shortlisting a provider for accounts receivable services:

1. Industry-Specific Expertise

Does the provider understand your sector’s nuances?

For example, AR strategies for SaaS differ vastly from those in manufacturing or healthcare. The ideal partner will have:

Case studies or references in your industry

Knowledge of your customer payment cycles

Familiarity with regulations (HIPAA, SOX, GDPR, etc.)

2. Technology-Driven Capabilities

In 2025, automation is non-negotiable. The best outsourced accounts receivable services use:

AI-powered invoice generation and delivery

Automated payment reminders

Predictive analytics to assess customer risk

Cloud-based portals with real-time dashboards

If your provider isn’t tech-forward, you risk falling behind competitors.

3. Security and Compliance Readiness

When you outsource accounts receivable services, especially offshore, compliance is critical. Make sure your provider offers:

Data encryption (at rest and in transit)

ISO 27001 or SOC 2 certifications

GDPR, PCI-DSS, and CCPA compliance

Audit-ready documentation and reports

Your finance team must feel confident that data is safe, accessible, and legally protected.

4. Scalability and Flexibility

As your business grows, will your AR partner grow with you?

Check if the provider can:

Add more resources during peak seasons

Integrate with your existing ERP or CRM systems

Offer modular services (full or partial AR outsourcing)

This flexibility is especially important for businesses expanding into new geographies.

5. Customer Communication & White-Labeling

AR isn’t just about invoices—it’s part of the customer experience. Top-tier offshore accounts receivable services often include:

White-labeled communication under your brand

Multilingual customer support

Professional tone and structured follow-up processes

This ensures customer relationships remain strong, even when payments are delayed.

6. Transparent Reporting and KPIs

Ask about reporting before you sign the contract. CFOs need visibility. Ideal providers offer:

Weekly or monthly performance dashboards

Real-time metrics on aging, collections, and disputes

Customized reports aligned with your goals

Transparency ensures alignment and continuous improvement.

Offshore AR Services: Are They Right for You?

Offshore Accounts Receivable Management has become a viable and strategic option for businesses looking to reduce cost while maintaining quality.

Benefits include:

24/7 operations across time zones

Lower labor and operational costs

Access to skilled finance professionals

Global compliance experience

Providers in countries like India and the Philippines offer strong English fluency, finance certifications, and tech integration—all essential for world-class accounts receivable management services.

Questions CFOs Should Ask Before Signing

Here’s a practical checklist of questions to ask potential AR providers:

What industries do you specialize in?

What technologies and platforms do you use?

How do you ensure data security and regulatory compliance?

What KPIs do you report, and how often?

Can you integrate with our ERP (e.g., SAP, NetSuite, QuickBooks)?

What is your escalation process for unresolved invoices or disputes?

Do you offer offshore, onshore, or hybrid models?

How do you handle communication with our customers?

The answers to these will help you identify the right strategic partner—not just a vendor.

Final Thoughts: It’s Not Just About Collections—It’s About Strategic Impact

For today’s CFOs, selecting the right accounts receivable outsourcing services is no longer a back-office decision—it’s a strategic move that impacts cash flow, customer satisfaction, risk exposure, and business agility. When done right, outsourced accounts receivable services free up your internal team, provide better insights, and unlock capital that fuels growth.

Ready to Choose a Smarter AR Partner?

At KMK Ventures, we help CFOs simplify, streamline, and scale their AR operations. With deep expertise in offshore accounts receivable management, automation-driven platforms, and strong compliance protocols, we’re built to support modern finance leaders.

Let’s connect—and build a future-ready AR strategy together.