In today’s fast-paced financial landscape, businesses are under increasing pressure to move faster, reduce costs, and operate smarter. Traditional paper-based and on-premise accounts payable (AP) systems just can’t keep up anymore. That’s where cloud-based accounts payable solutions are stepping in—and transforming finance operations across industries. But what makes cloud-based AP systems the go-to choice in 2025 and beyond? Let’s explore why they’re not just a trend but the future of finance

What Is a Cloud-Based Accounts Payable System?

Unlike traditional systems that require local servers, manual data entry, and physical document handling, cloud-based platforms offer real-time access, automated workflows, and seamless integrations with ERP software like NetSuite accounts payable automation

These solutions simplify the end-to-end process of accounts payable—and offer key strategic advantages that modern finance teams can’t afford to ignore.

Why Are Finance Teams Making the Shift?

❓Is your AP team still buried in paper invoices and email approvals?

That might be costing your business more than just time. Let’s take a look at the major reasons companies are embracing automated accounts payable solutions in the cloud

1. Unmatched Accessibility and Flexibility

With remote work becoming the norm, finance teams need tools that offer access from anywhere, at any time. Cloud-based AP systems are hosted online, enabling your team to:

Approve invoices from mobile or desktop devices

Monitor payment status in real time

Collaborate across departments and locations

Whether you’re working from the office or halfway around the globe, your accounts payable automation process keeps running smoothly

2. End-to-End Process Automation

Here’s how automated accounts payable solutions enhance efficiency:

Invoice Capture: AI-powered data extraction reduces manual entry errors

Approval Workflows: Customizable routing accelerates sign-offs

Payment Processing: Secure, automated payments to vendors

Audit Trails: Real-time logs ensure transparency and compliance

These features are built into modern cloud solutions, allowing teams to manage the full AP lifecycle without bottlenecks.

3. Seamless Integration with ERP Systems

Most leading cloud-based AP systems are designed to integrate with enterprise software like NetSuite, QuickBooks, SAP, and Microsoft Dynamics.

For example, NetSuite accounts payable automation syncs your invoice and payment data directly with your ERP, ensuring accurate financial reporting and eliminating duplicate data entry.

The result? Unified finance operations and fewer reconciliation headaches.

4. Enhanced Security and Compliance

Concerned about data breaches or audit trails?

Cloud platforms offer bank-grade encryption, user-based access controls, and automatic backups. This is crucial for maintaining:

Regulatory compliance (e.g., SOX, VAT, GST)

Vendor payment accuracy

Internal controls and fraud prevention

Outsourced providers also support built-in compliance features, making it easier for businesses to outsource accounts payable with peace of mind.

5. Real-Time Visibility and Analytics

Modern finance leaders need insights—not just data.

Cloud-based AP systems provide dashboards and real-time analytics, helping you monitor:

Invoice aging

Vendor payment cycles

Cash flow forecasts

AP turnover ratios

These insights empower data-driven decision-making and support better vendor negotiations.

6. Reduced Costs and Manual Labor

Did you know that businesses still relying on manual AP processes spend an average of $10–15 per invoice?

With accounts payable automation, that cost can drop to under $2 per invoice. Here’s where you save:

Labor hours on data entry and approval chasing

Paper, printing, and postage costs

Late payment penalties and missed early payment discounts

Outsourcing to a cloud-based provider further reduces operational overhead, offering a cost-effective alternative to in-house teams.

7. Scalable and Future-Proof

Need to process more invoices during the busy season? Expanding into new regions?

Cloud-based systems are designed to scale with your business. Whether you process 1,000 or 100,000 invoices monthly, your AP process stays consistent, secure, and optimized.

Answering Common Questions

Let’s address some of the most common questions finance teams ask when considering the shift:

Q: Is a cloud-based AP system suitable for small businesses?

Absolutely. Many providers offer tiered pricing models, making cloud based accounts payable solutions affordable for startups and mid-sized businesses.

Q: How does automation work with our existing accounting tools?

Leading systems support ERP integrations (like NetSuite accounts payable automation) and offer APIs to connect with your preferred platforms.

Q: Will my finance team lose control by outsourcing?

No. With cloud-based AP, you gain more visibility and control through real-time dashboards and automated approval workflows—even when you outsource accounts payable.

Q: Is the cloud really secure for financial data?

Yes. Reputable providers follow strict data security standards like SOC 2, ISO 27001, and GDPR compliance, offering better protection than most in-house systems.

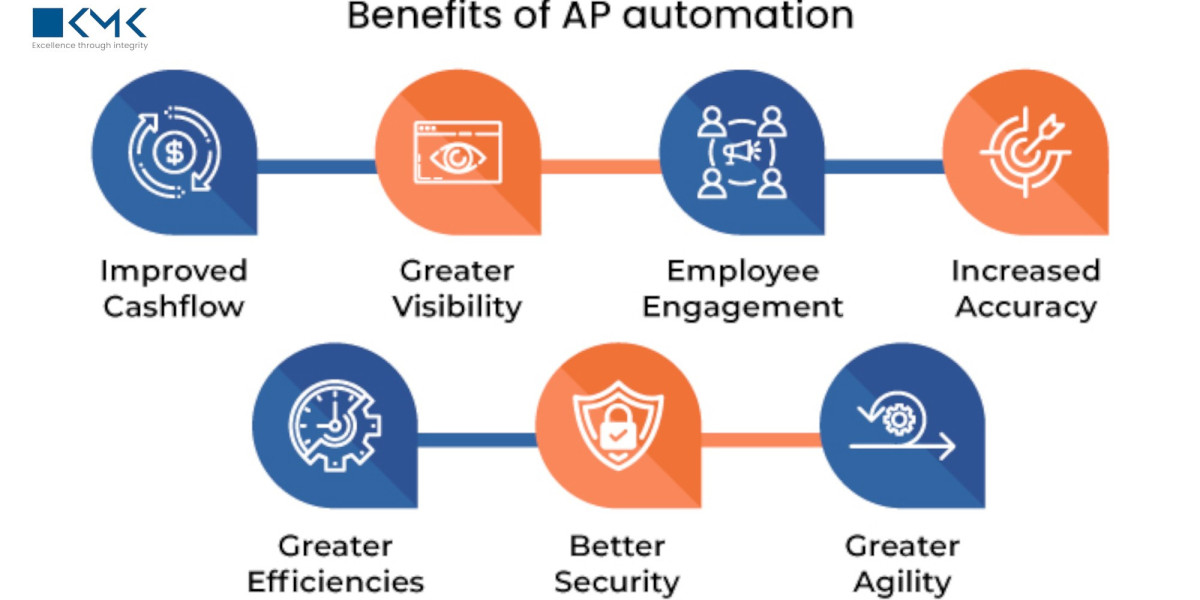

Key Benefits at a Glance

Here’s a quick summary of why cloud based accounts payable solutions are the future:

✅ 24/7 access from any location

✅ Automation of repetitive tasks

✅ Lower invoice processing costs

✅ Stronger security and compliance

✅ Real-time visibility into AP metrics

✅ Seamless ERP integration

✅ Scalable for growth

Final Thoughts: Time to Modernize Your AP Process

In 2025, cloud-based accounts payable systems are not just a luxury—they're a necessity. As businesses continue to prioritize speed, accuracy, and remote collaboration, traditional AP methods simply can’t compete. By combining accounts payable automation with cloud-based infrastructure, companies unlock new levels of efficiency, transparency, and agility. Whether you're a fast-growing startup or an enterprise managing complex P2P accounts payable cycles, the future of finance lies in the cloud.