In right this moment's financial panorama, the necessity for personal loans has grow to be increasingly common. Whether it's for consolidating debt, covering unexpected bills, or financing a significant purchase, personal loans can supply a viable answer. However, for people with bad credit score, the technique of acquiring a best personal line of credit for bad credit loan could be daunting. This report goals to offer a detailed overview of personal loans for those with bad credit, including the challenges they face, choices obtainable, and tips for bettering their possibilities of approval.

Understanding Bad Credit

Dangerous credit score usually refers to a credit score rating that falls below 580, as measured by the FICO scoring system. This rating can end result from varied factors, including missed funds, high credit utilization, defaults, or bankruptcy. Individuals with dangerous credit score typically discover themselves in a precarious monetary situation, struggling to safe loans or credit cards, and going through larger curiosity rates after they do qualify.

The need for Personal Loans

Despite the challenges associated with bad credit, the necessity for personal loans can arise for a number of reasons:

- Debt Consolidation: Many individuals with dangerous credit score could have accumulated multiple debts from credit playing cards or other loans. A personal loan might help consolidate these debts into a single month-to-month payment, probably at a decrease interest price.

- Medical Expenses: Unexpected medical payments can create monetary strain. Personal loans can present the mandatory funds to cover these bills when medical health insurance falls quick.

- House Repairs: Homeownership comes with its share of tasks. Main repairs or renovations can require important financial funding, making personal loans an attractive option.

- Training Bills: For these looking to further their education or pursue vocational training, personal loans can help cover tuition and associated costs.

- Emergency Bills: Life is unpredictable, and emergencies can arise at any second. Personal loans can offer fast access to funds for urgent conditions, resembling automobile repairs or pressing journey.

Challenges of Securing a Personal Loan with Bad Credit

People with bad credit face several obstacles when making use of for personal loans:

- Increased Curiosity Charges: Lenders typically see these with bad credit as excessive-risk borrowers, leading to larger interest charges. If you have just about any queries regarding wherever and how to employ personal loans for bad credit easy approval loans for people with bad credit history (click through the up coming article), it is possible to call us at the web site. This could make loans costlier over time.

- Limited Options: Many conventional lenders, including banks and credit unions, might decline applications from people with bad credit. This can restrict their options to different lenders, which can have much less favorable terms.

- Prepayment Penalties: Some lenders could impose penalties for paying off loans early, which will be an obstacle if the borrower finds themselves in a greater financial state of affairs.

- Loan Amounts: Individuals with bad credit score may face restrictions on the quantity they'll borrow, which may not meet their monetary needs.

Choices for Personal Loans with Bad Credit

Regardless of these challenges, there are a number of choices available for individuals seeking personal loans with unhealthy credit score:

- On-line Lenders: Many on-line lenders specialise in providing loans to individuals with bad credit. These lenders typically have extra flexible standards and should offer faster approval processes compared to traditional banks.

- Credit score Unions: Credit unions are member-owned financial establishments that may offer more favorable phrases to their members, including these with unhealthy credit. They may additionally provide personalized assistance find the precise loan.

- Peer-to-Peer Lending: Platforms that facilitate peer-to-peer lending connect borrowers with individual traders keen to fund their loans. This is usually a viable choice for those with unhealthy credit score, as traders might consider factors past just credit score scores.

- Secured Loans: Secured personal loans for bad credit online loans require collateral, similar to a vehicle or savings account. This reduces the lender's threat, making it simpler for individuals with unhealthy credit score to secure funding.

- Co-Signers: Having a co-signer with good credit karma best personal loans for bad credit can improve the chances of loan approval. The co-signer agrees to take responsibility for the loan if the borrower defaults, offering extra safety for the lender.

Suggestions for Improving Probabilities of Approval

Individuals with dangerous credit score can take several steps to enhance their possibilities of securing a personal loan:

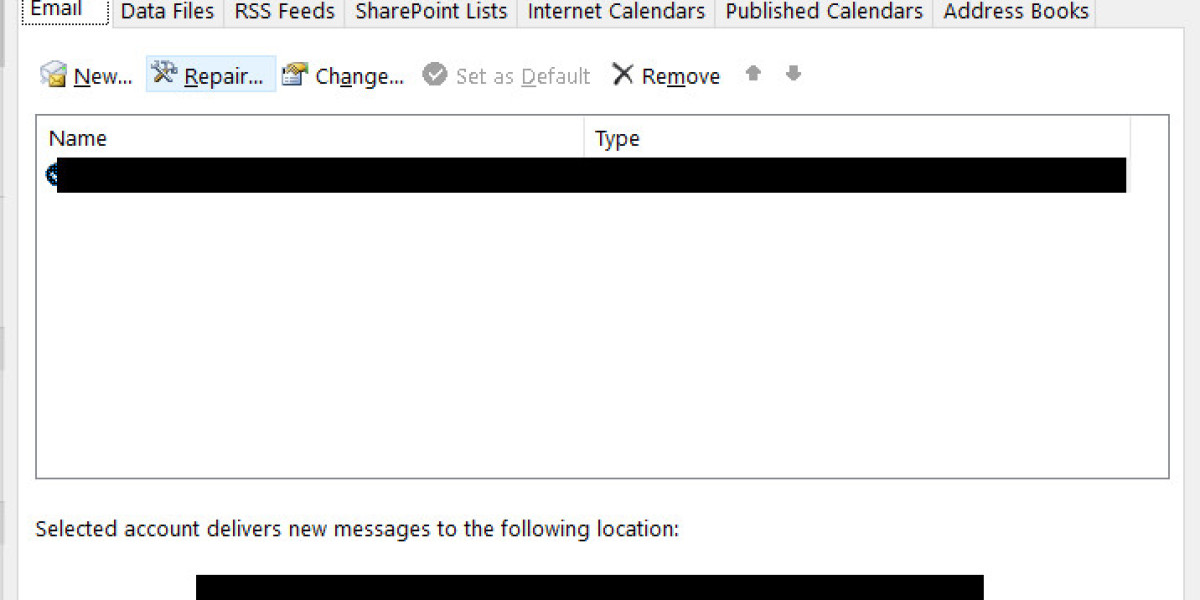

- Check Credit Reports: Earlier than making use of for a loan, it's important to assessment credit score reviews for errors or inaccuracies. Disputing these errors can help enhance credit score scores.

- Enhance Credit score Score: Taking steps to improve credit scores, such as paying down existing debts, making funds on time, and reducing credit score utilization, can improve eligibility for loans.

- Analysis Lenders: Not all lenders have the same standards for assessing creditworthiness. Researching varied lenders will help identify those extra keen to work with people with bad credit score.

- Put together Documentation: Having obligatory documentation prepared, resembling proof of income, employment historical past, and identification, can expedite the applying course of and improve the likelihood of approval.

- Consider Smaller Loan Amounts: Making use of for a smaller loan quantity might improve the probabilities of approval, as lenders could also be extra willing to take on less threat with a decrease loan amount.

Conclusion

Securing a personal loan with unhealthy credit can be challenging, but it isn't unattainable. By understanding the choices obtainable, the challenges confronted, and the steps to improve their chances of approval, people can navigate the lending landscape extra effectively. Whether or not for debt consolidation, emergency expenses, or other financial wants, personal loans can present a essential lifeline for those working to rebuild their credit score and regain monetary stability. With cautious planning and knowledgeable determination-making, individuals can find the monetary help they want, even in the face of dangerous credit score.